Originals & Clones: Merge-3

Merge Dragons!, the evergreen hit and the first successful Merge game, laid the basis for the traditional Merge-3 mechanic and spawned a lot of Merge Dragons!-like titles, or MDLs.

The second hit game to enter the Merge-3 market is EverMerge. The release of EverMerge in 2020 brought innovation to the sub-genre - the removal of the level based system, or saga-map like Merge Dragons! has. This new entrant created another subset - EverMerge-like, or EMLs.

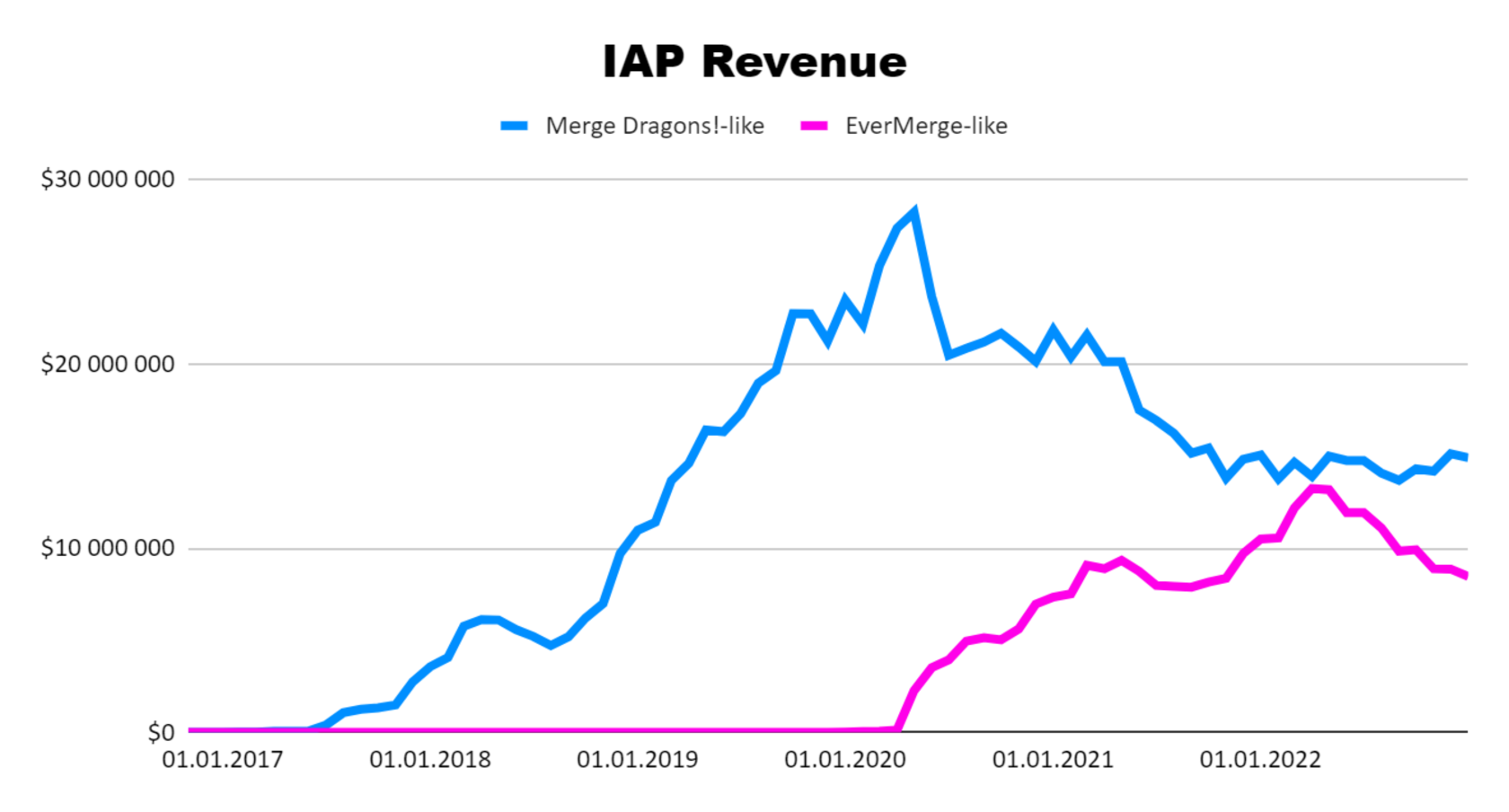

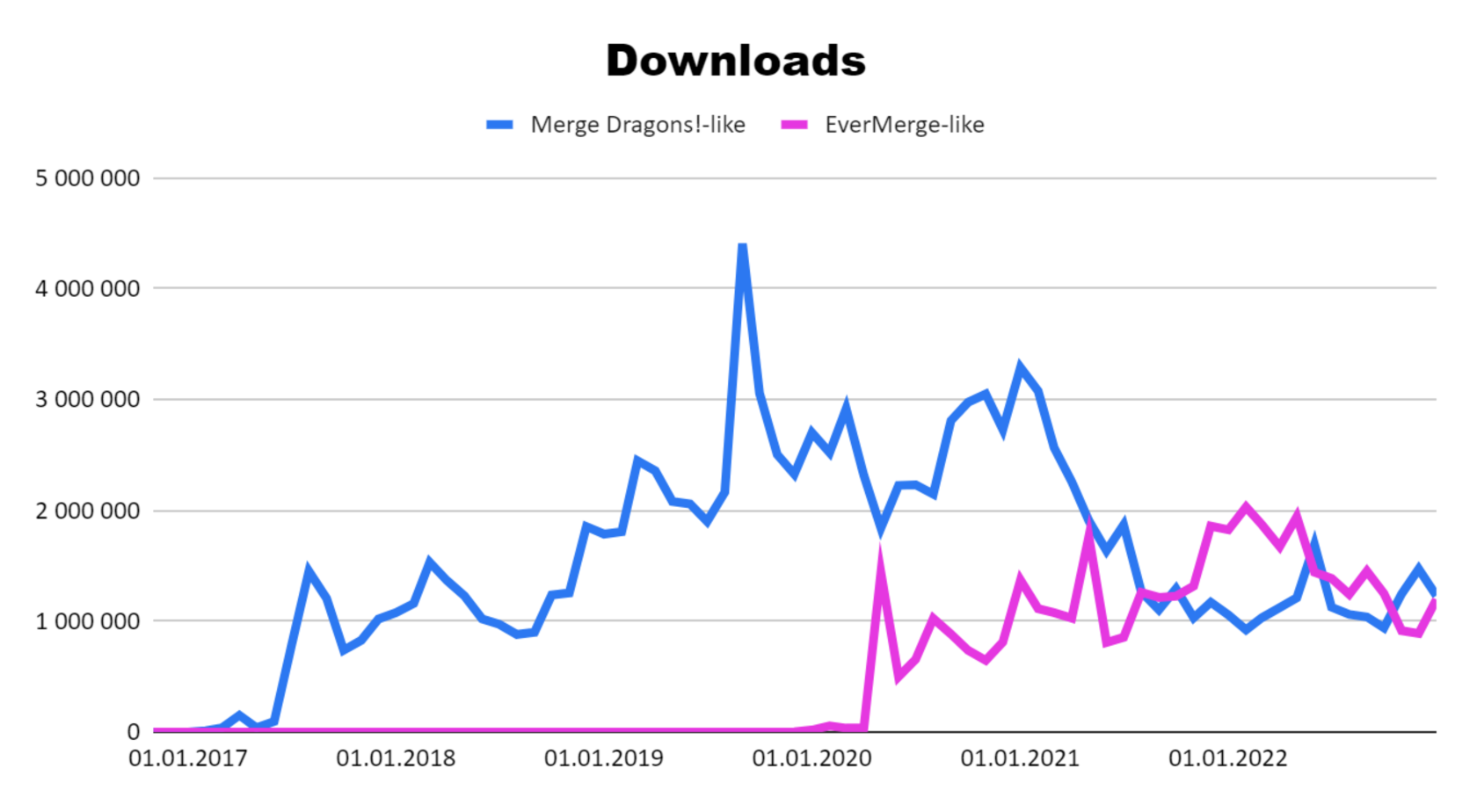

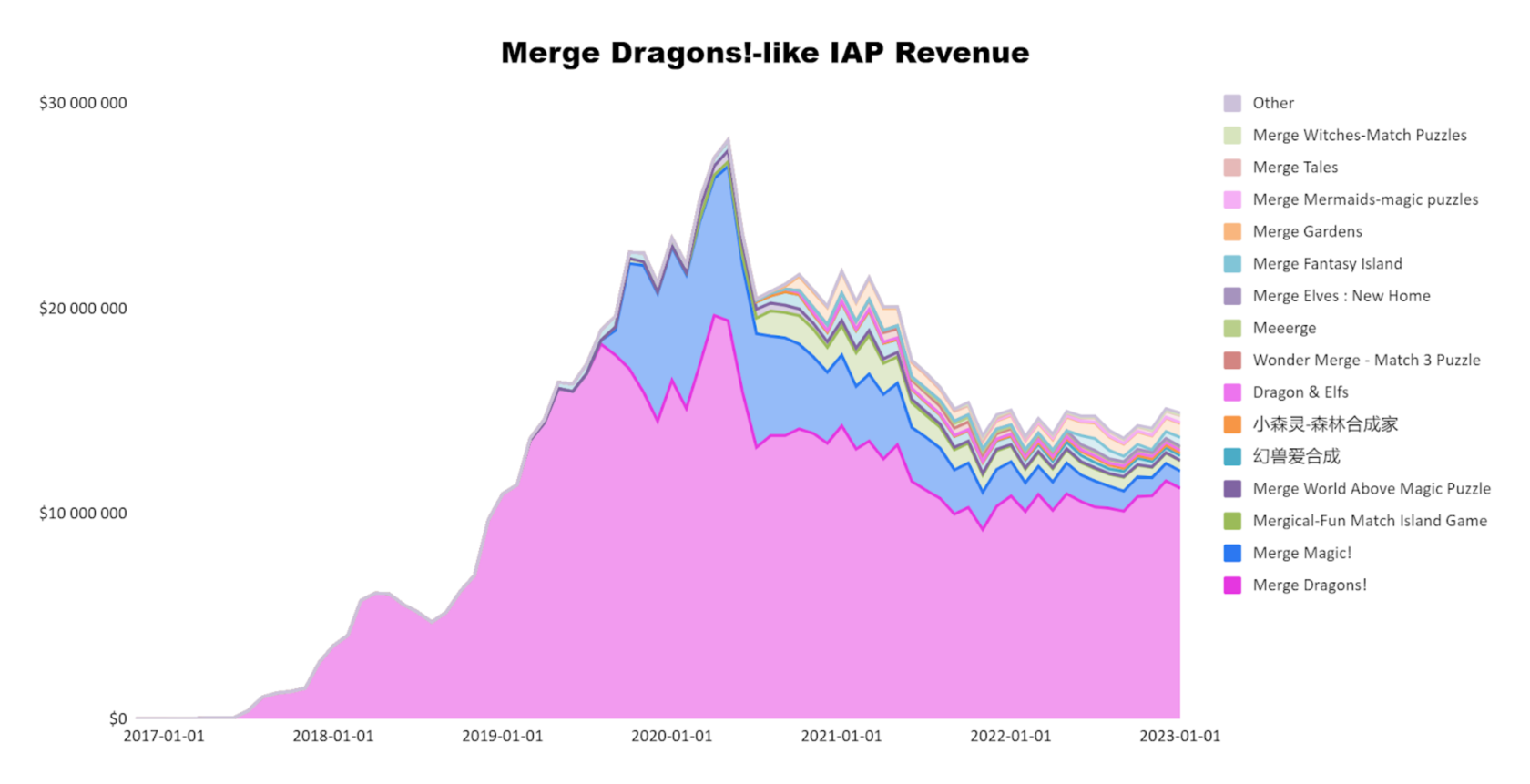

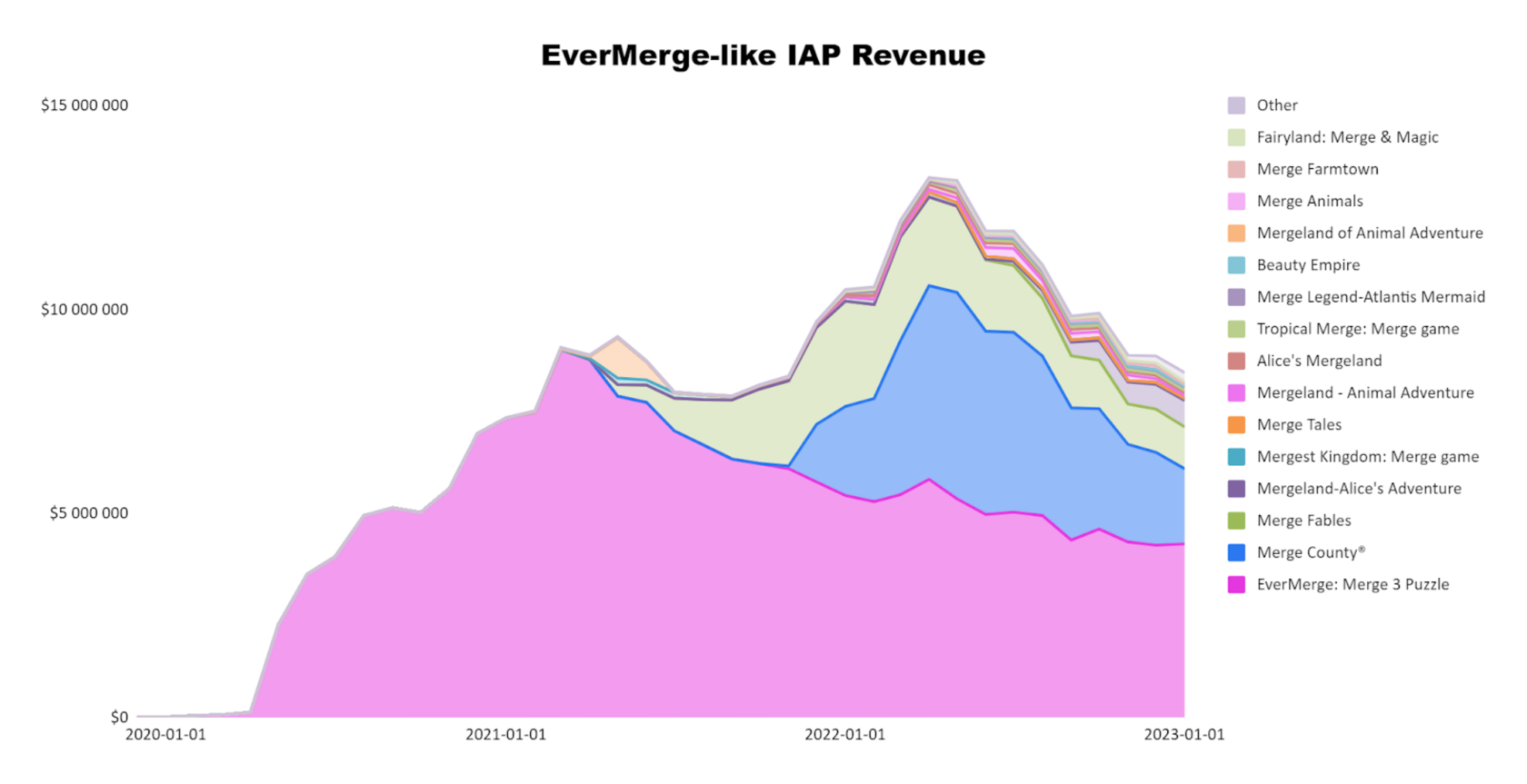

Having experienced enormous growth until 2020, MDL’s IAP revenue as well as downloads have steeply decreased since then. Nevertheless, MDLs continue to dominate with $14.9M IAP revenue in January of 2023 against $8.4M for EMLs while downloads for these sub-genres are approximately on the same level (around 1.2M).

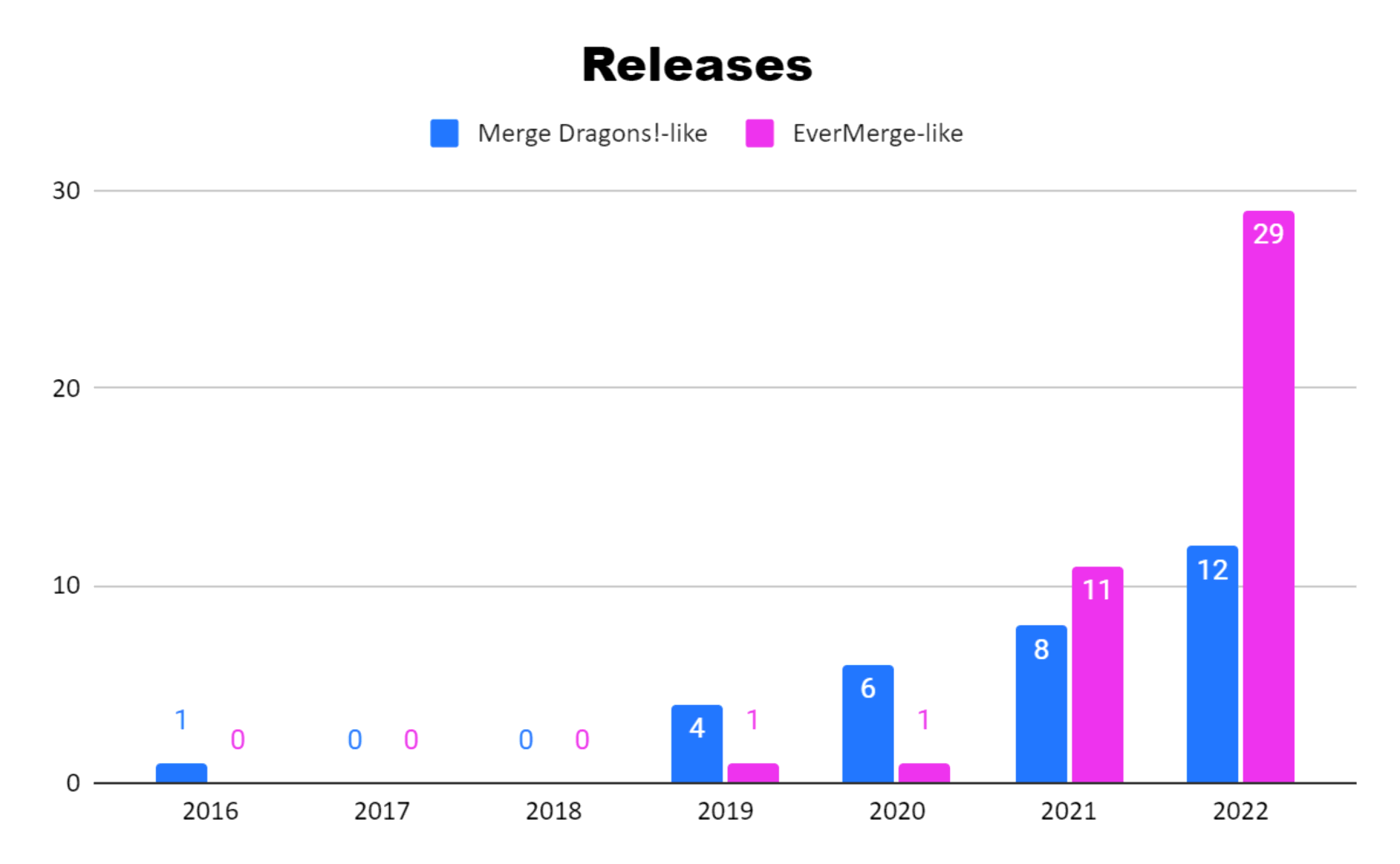

Having been released in 2016, Merge Dragons! stayed the only title in the MDL sub-genre during the following 2 years. Starting from 2019, 30 re-skins appeared with 12 of them being released in 2022. The EMLs group is much more numerous - about 40 titles have been released during the last 2 years.

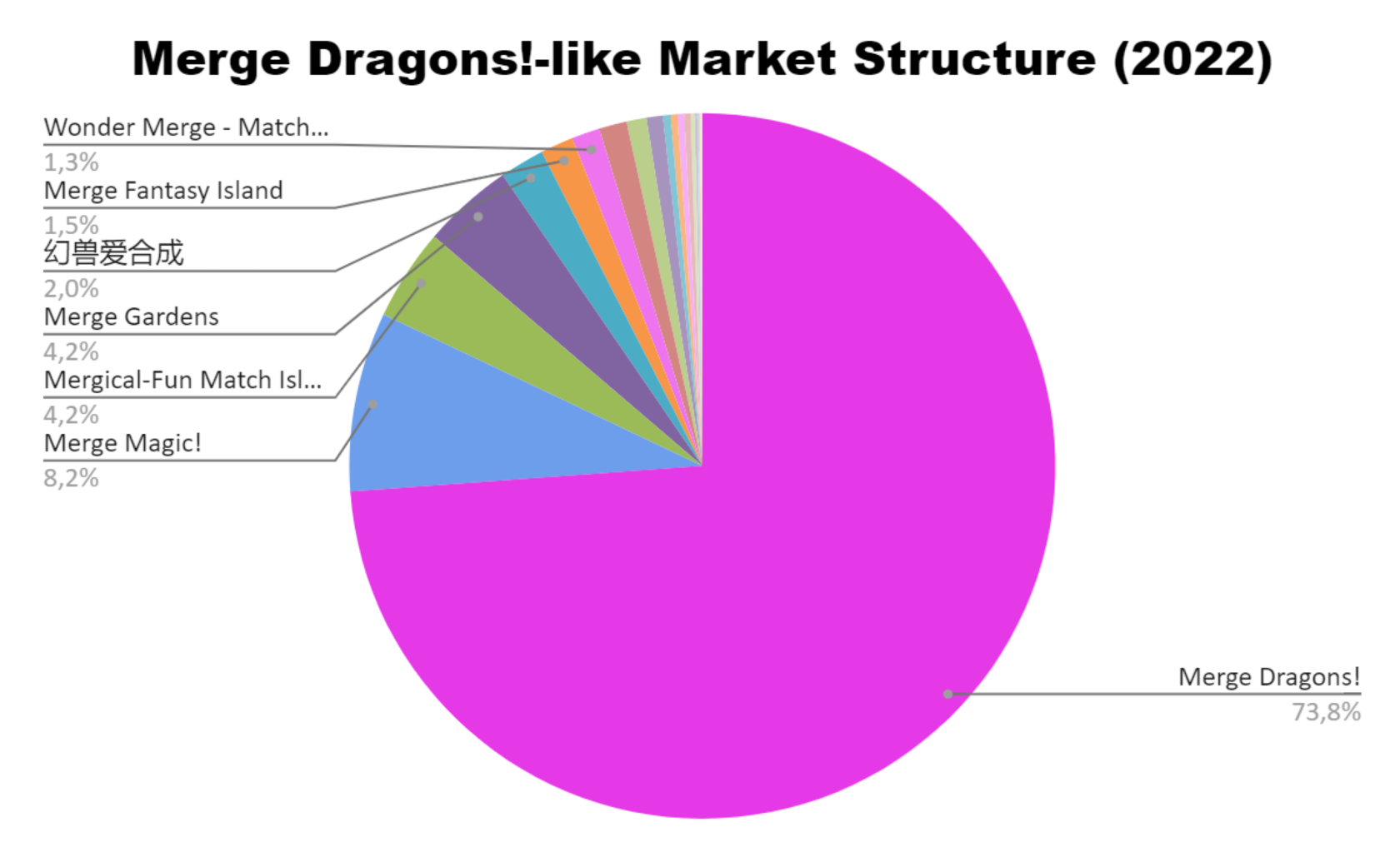

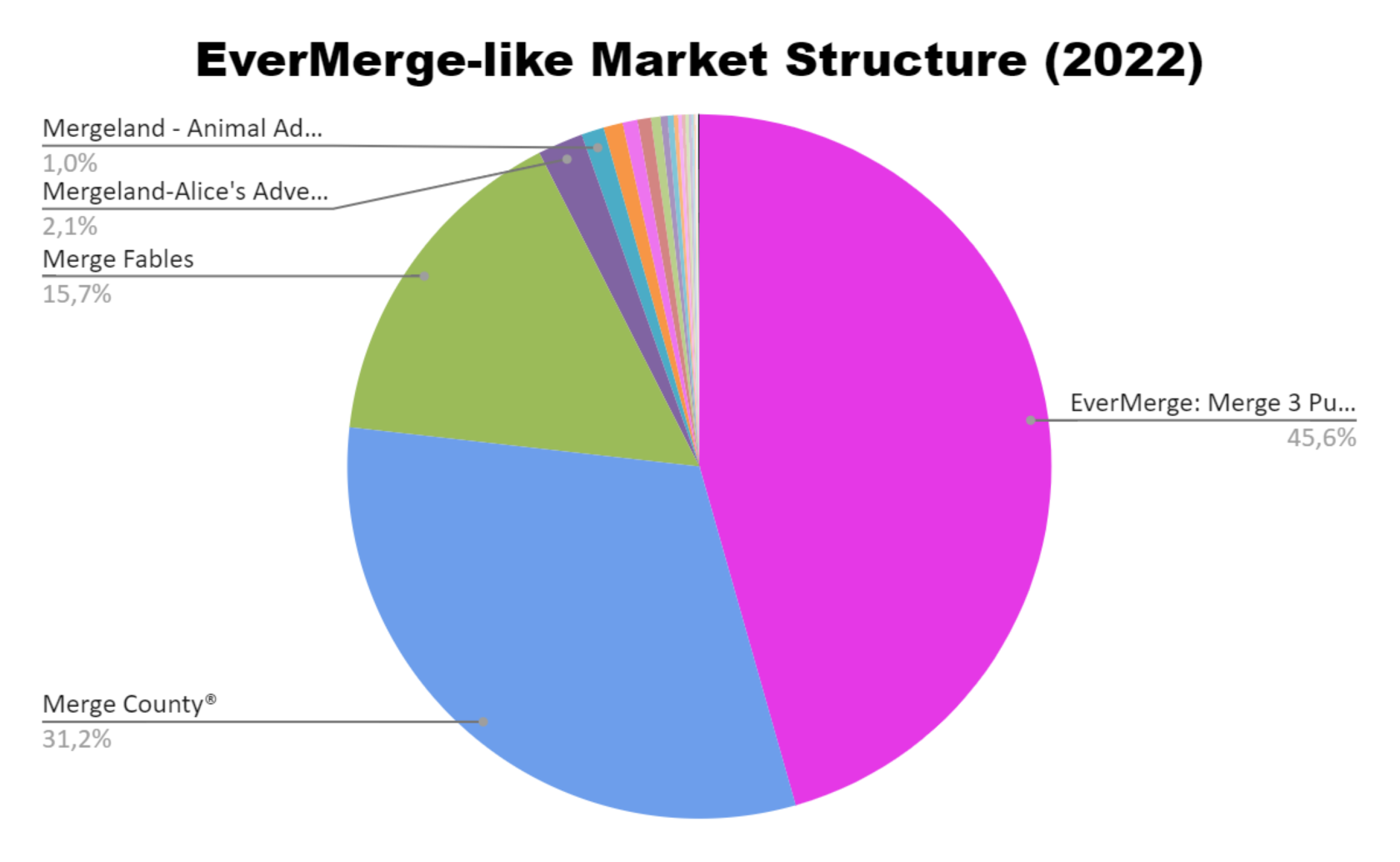

The IAP revenue market structure for both sub-genres in 2022 indicates another difference between these two just right off the boat - Merge Dragons! tightly controls its market with 73.8% (!) of IAP revenue share, while EverMerge easily gave way to its clones (especially to Merge County and Merge Fables) and retained only 45.6% market share.

The dynamics of titles’ contributions to overall IAP revenue demonstrate that Merge Dragons! has been the undisputed king in the sub-genre throughout the years. The only project that could come closer to the original is Merge Magic!. Its success is easy to explain: Merge Magic! and Merge Dragons! were both developed by Gram Games and were the first to appear on the market. By the way, these two factors are the classic keys to success in most cases.

Speaking about the EMLs market, the dynamic below represents a slightly different picture. For the last 2 years, EML’s leader has dramatically lost its position in the market allowing its main 2 followers - Merge County and Merge Fables - to get the lion’s market share. As for the remaining numerous EML titles, only a few of them were able to succeed. In other words, despite not being as monopolistic as MDLs market, EMLs is still not so open for young titles to enter the market without any innovation.

Originals & Clones: Merge-2

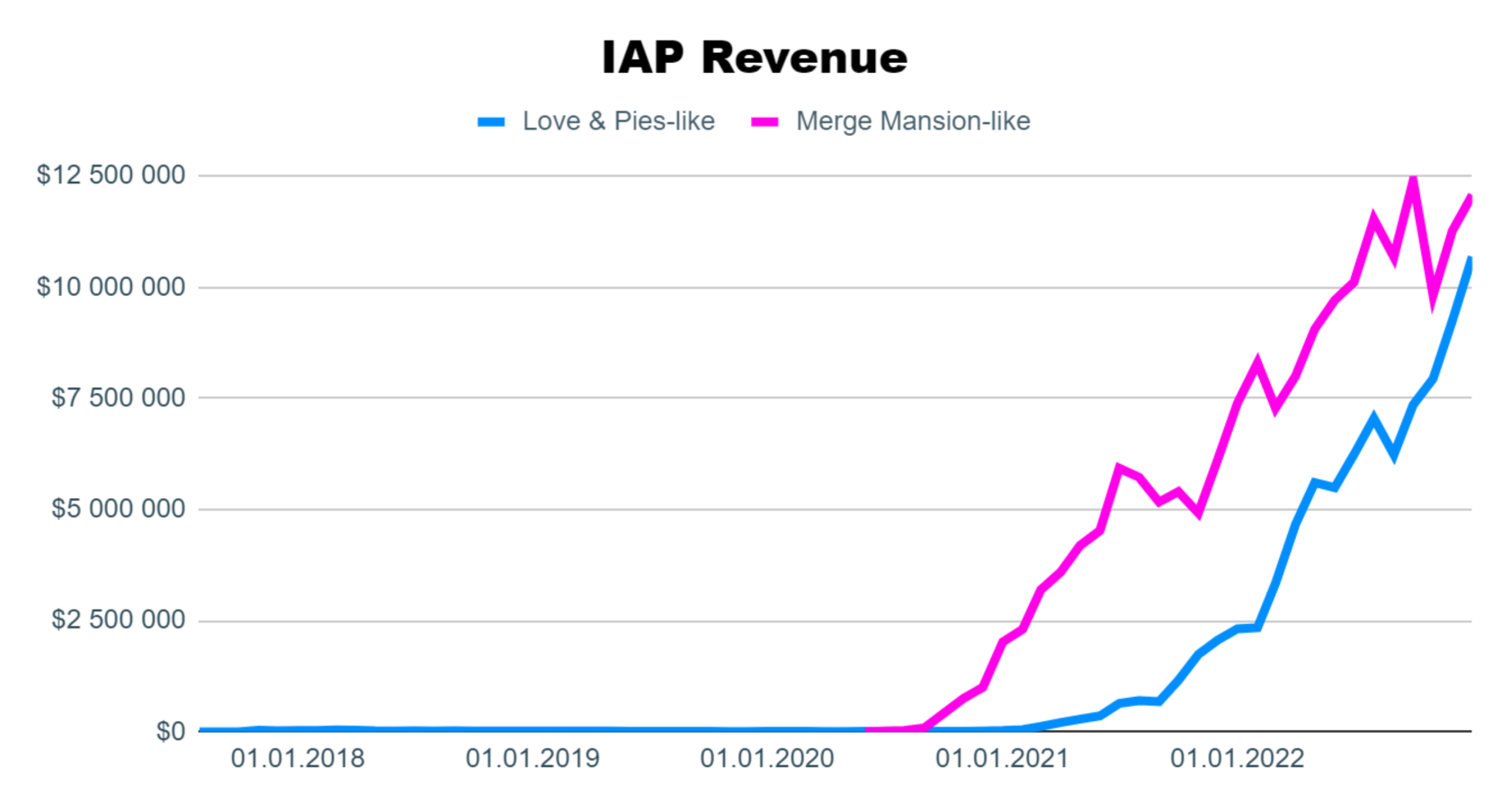

The Merge 2 sub-genre can also be divided into 2 categories. The first one includes clones of Merge Mansion, (

MMLs). The other group comprises titles similar to another successful Merge 2 game - Love & Pies (LPLs). The key difference between them lies in their “task system”.

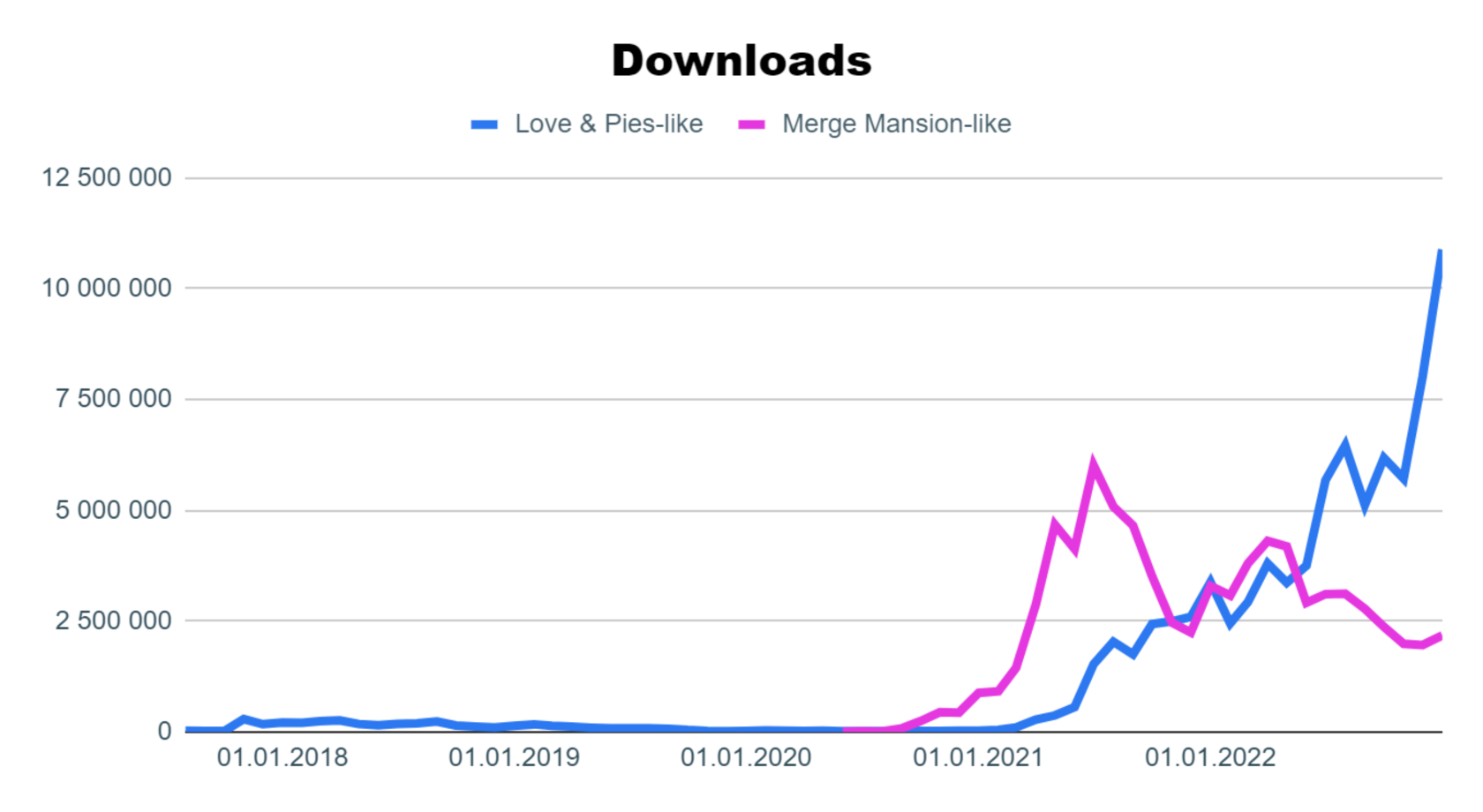

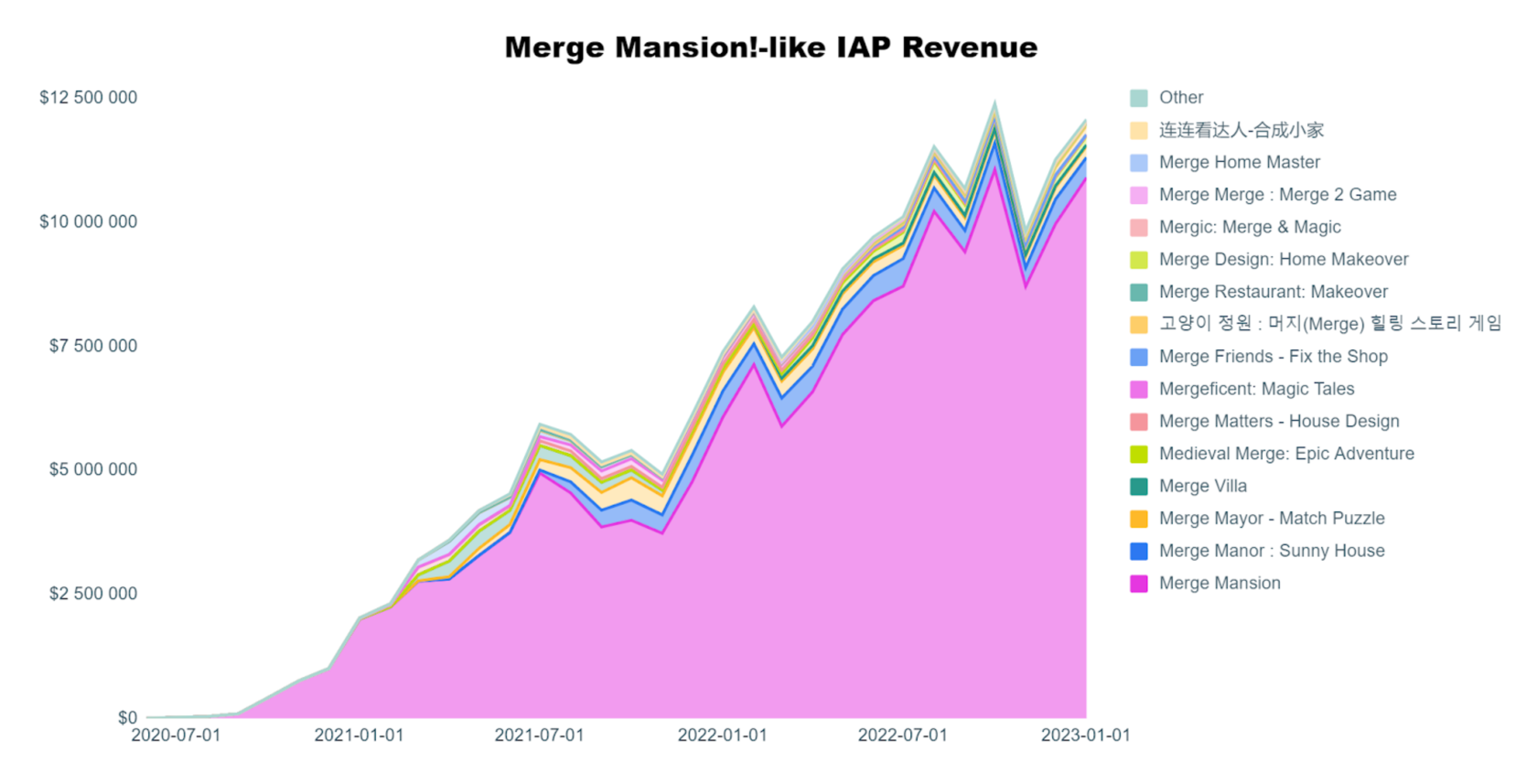

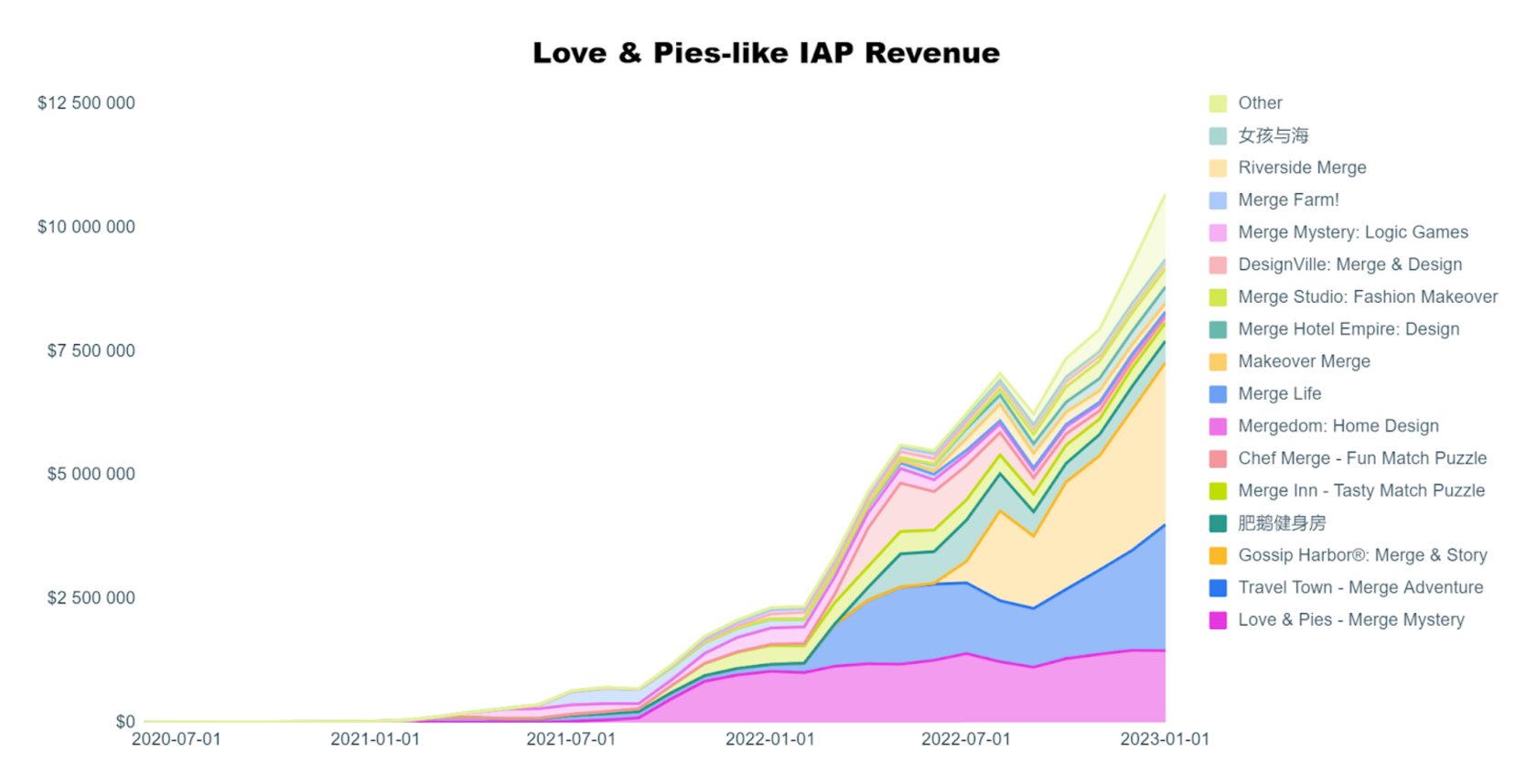

From a high-level perspective, MMLs and LPLs are neck and neck in the race to be the Merge-2 leader. Their markets are fast growing in IAP revenue, having earned more than $10M each in January 2023. However, the downloads dynamics are far more controversial. While MMLs experienced a drop in downloads starting in late 2021, LPLs reached their peak in January 2023 with 10.8M of overall downloads (compared to 2.2M for MMLs).

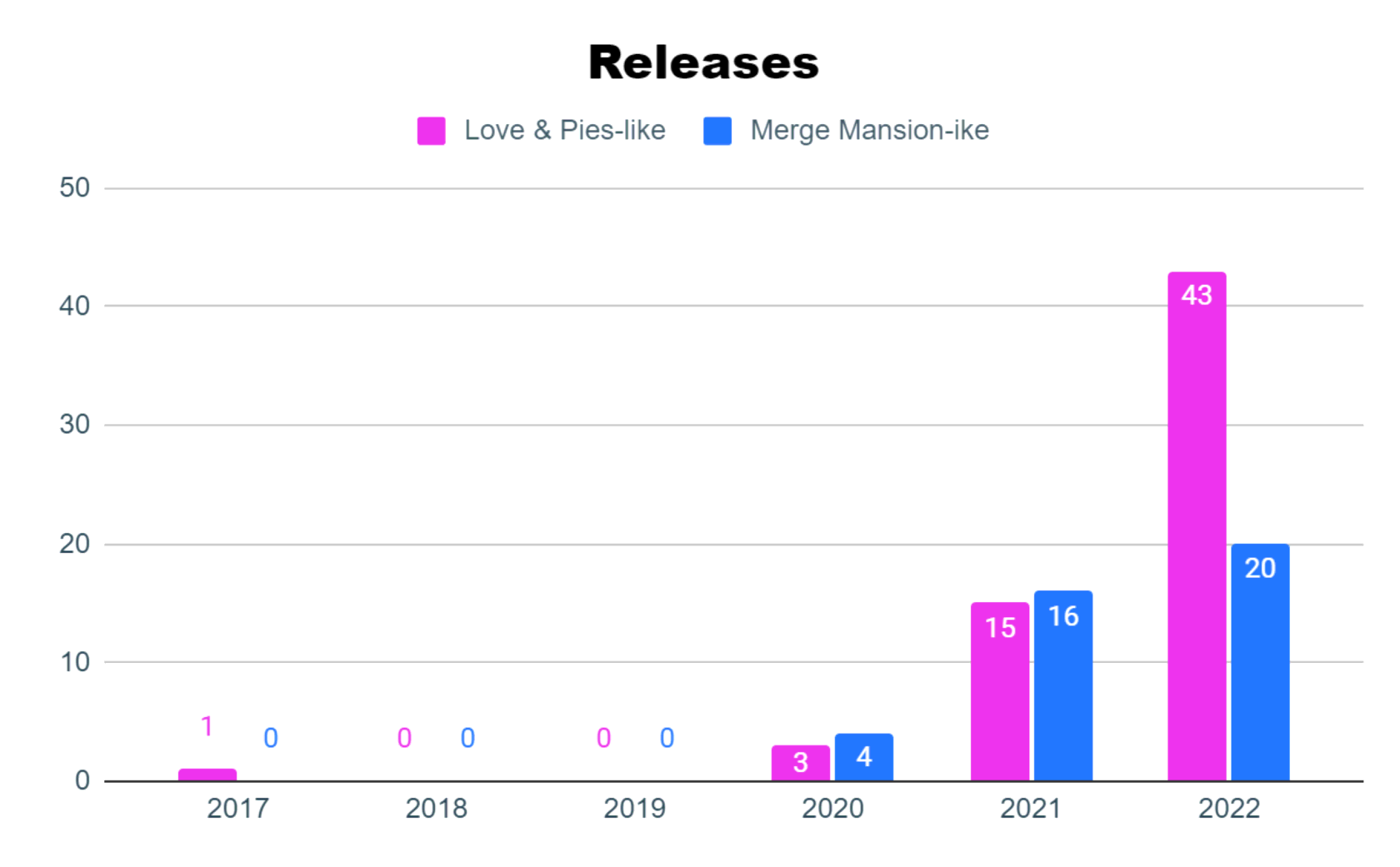

The release dynamics show an increase in new titles throughout the years, with LPLs reaching 43 releases in 2022 compared to 20 for MMLs.

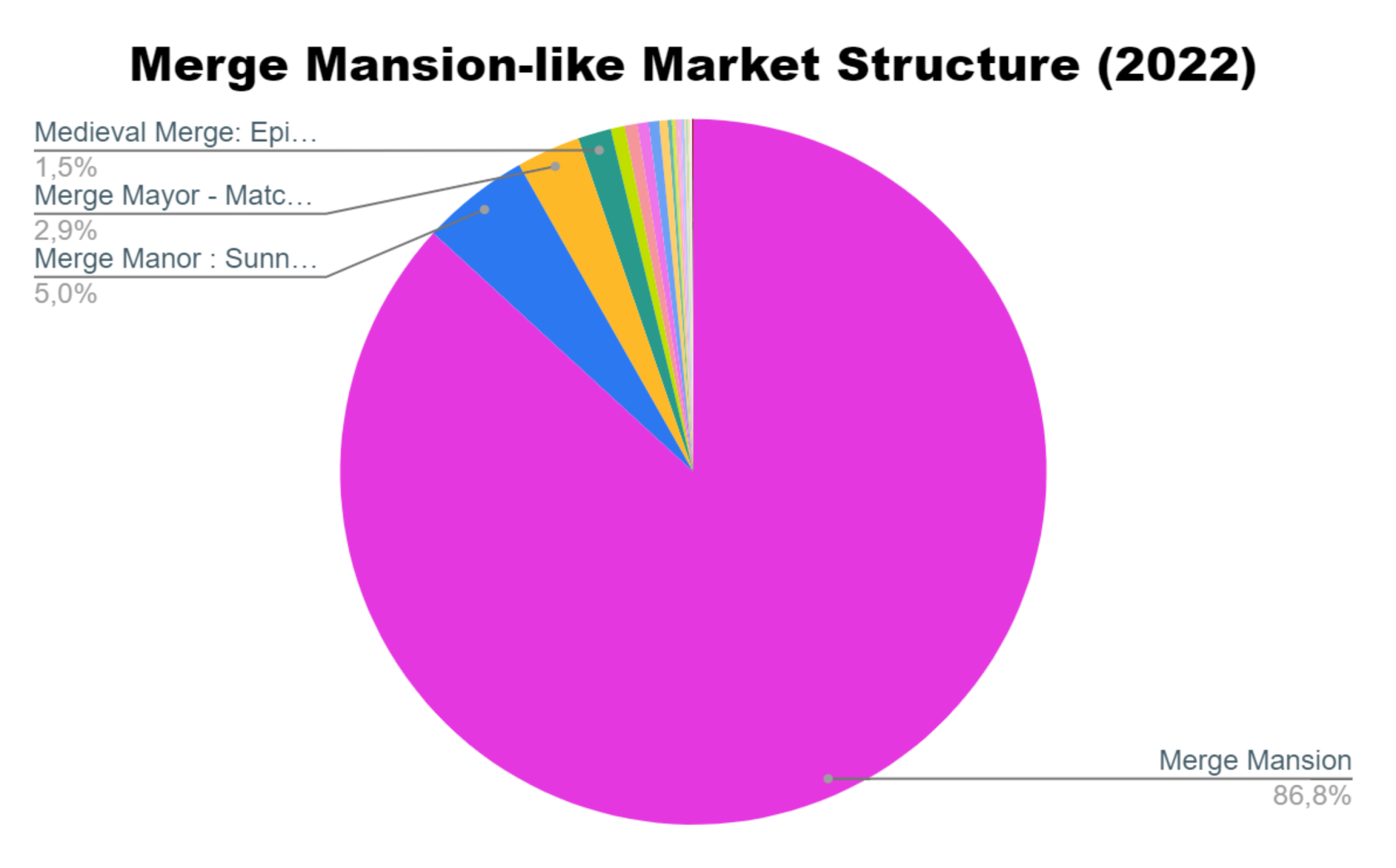

The IAP revenue market structure for 2022 takes the rose-colored glasses off of developers who still want to clone Merge Mansion. With 86% of the market, Merge Mansion doesn't let the other entrants come close to the leader. Moreover, there were attempts from Merge Mansion’s developer, MetaCore itself, to repeat their own hit. But despite the obvious benefits, they had no success.

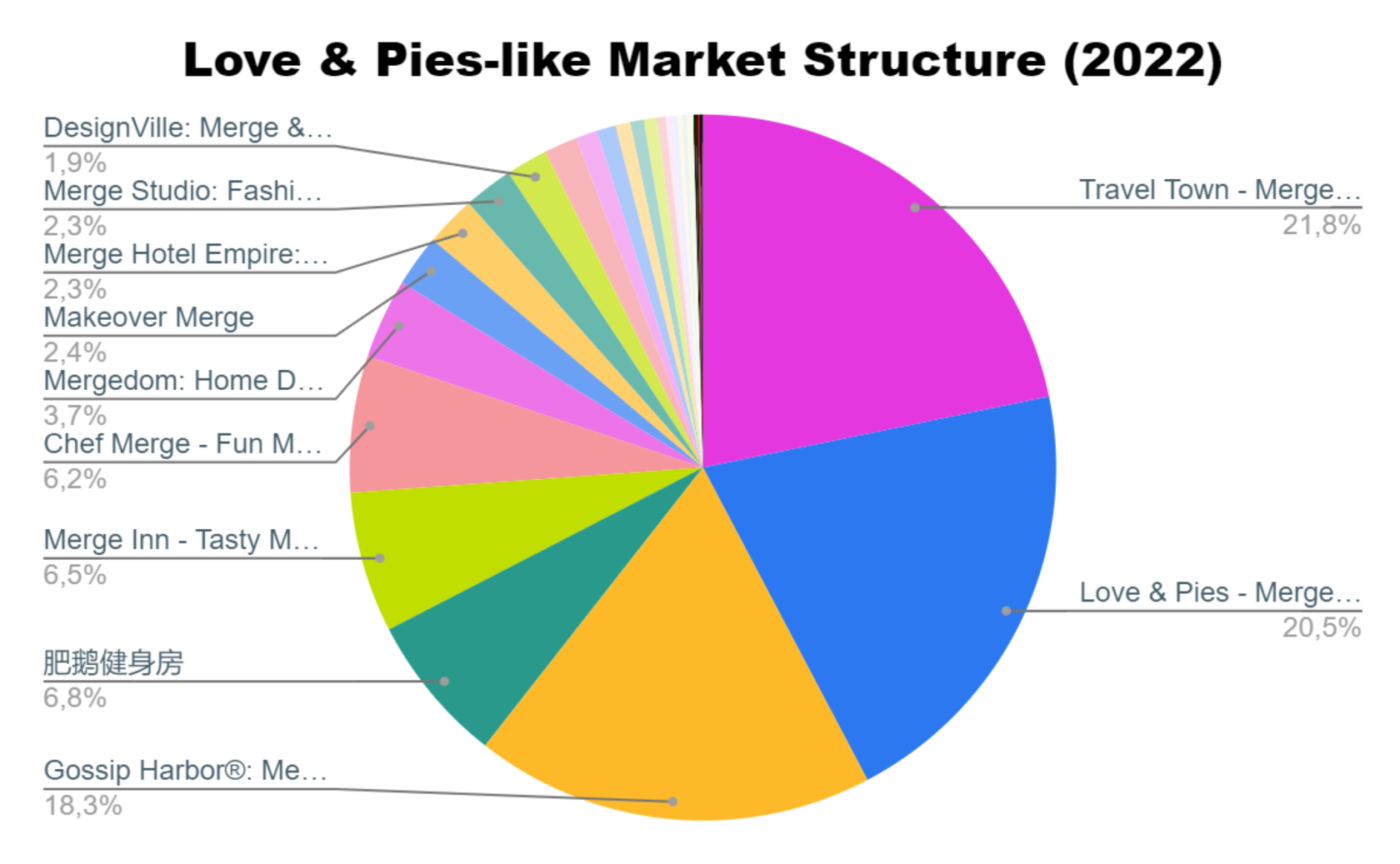

In contrast to MMLs, LPLs market is more open to new entrants - with only 20% of IAP revenue share, Love & Pies lets its followers bite off the remaining market. It is a good sign for developers to enter this market as the opportunity to get to the top is much higher than in the MMLs market.

The dominant position of Merge Mansion has remained unchanged throughout the history of the sub-genre.

The market share of LPLs is evenly distributed among contestants, allowing newcomers to take top positions. As an example, a newly released Gossip Harbor proves that it’s possible to take the top-grossing position for a young title.

Final Thoughts

Overall, the growing number of Merge titles has proven how popular and fresh this genre is. The big four of this market - Merge Dragons!, EverMerge, Merge Mansion, and Love & Pies - made other developers want to clone the hits. Eventually, it resulted in four new categories in the mobile market.

The analysis has shown that these subsets are very different from each other from a market structure point of view. For instance, the Love & Pies- like group seems to have the most open and non-monopolistic market, making it the best place to enter the Merge genre. In contrast, Merge Mansion-like is closed to new entrants as the lion’s share of the market is owned by its leader.

Speaking about the Merge-3 sub-genre, it’s not recommended to make another Merge Dragons!-like title for at least 2 reasons. Firstly, the IAP revenue of the Merge Dragons!-like group hasn't been growing for the last 2 years. Secondly, 84% share of the market is owned by Gram Games, Merge Dragons! and Merge Magic! developer. As for the EverMerge-like market, despite the growing number of releases, both its IAP revenue and downloads have dropped in the last year. Moreover, the IAP revenue market share almost fully belongs to three games (EverMerge, Merge County, and Merge Fables), which is the barrier for newcomers to enter the market.

Other articles in Analytics: