Market Growth

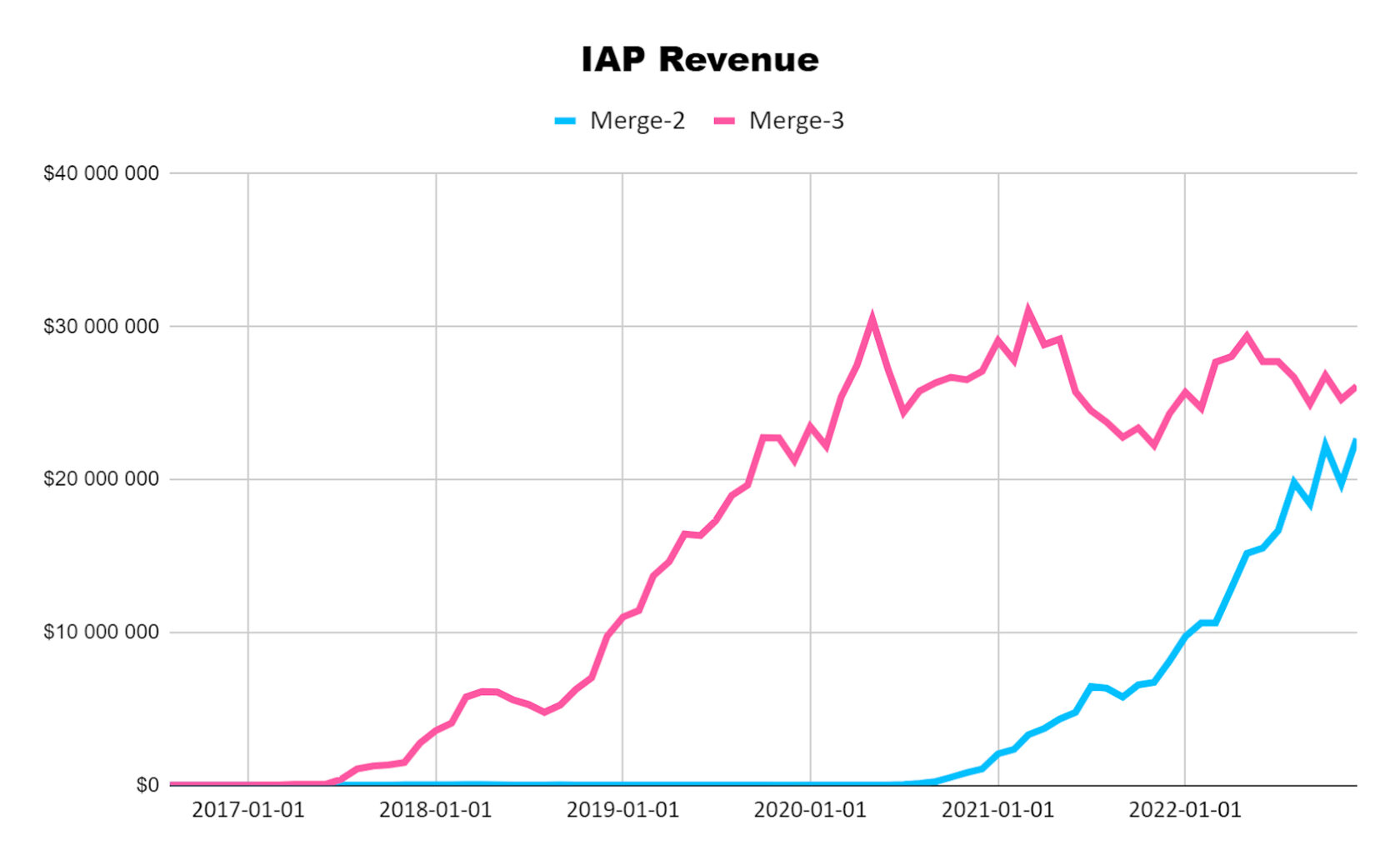

Though both genres appeared around the same time, Merge-2 lacked high-grossing titles for several years. In turn, Merge-3 intensively grew IAP revenue until 2020; since then, its earnings have become more stable. Despite the long stagnation, Merge-2 began to constantly increase its IAP revenue in the second half of 2020, almost reaching Merge-3 levels in the last months of 2022. In December of 2022, Merge-3 resulted in $26.1M cumulative IAP revenue while Merge-2 earned almost $22.7M.

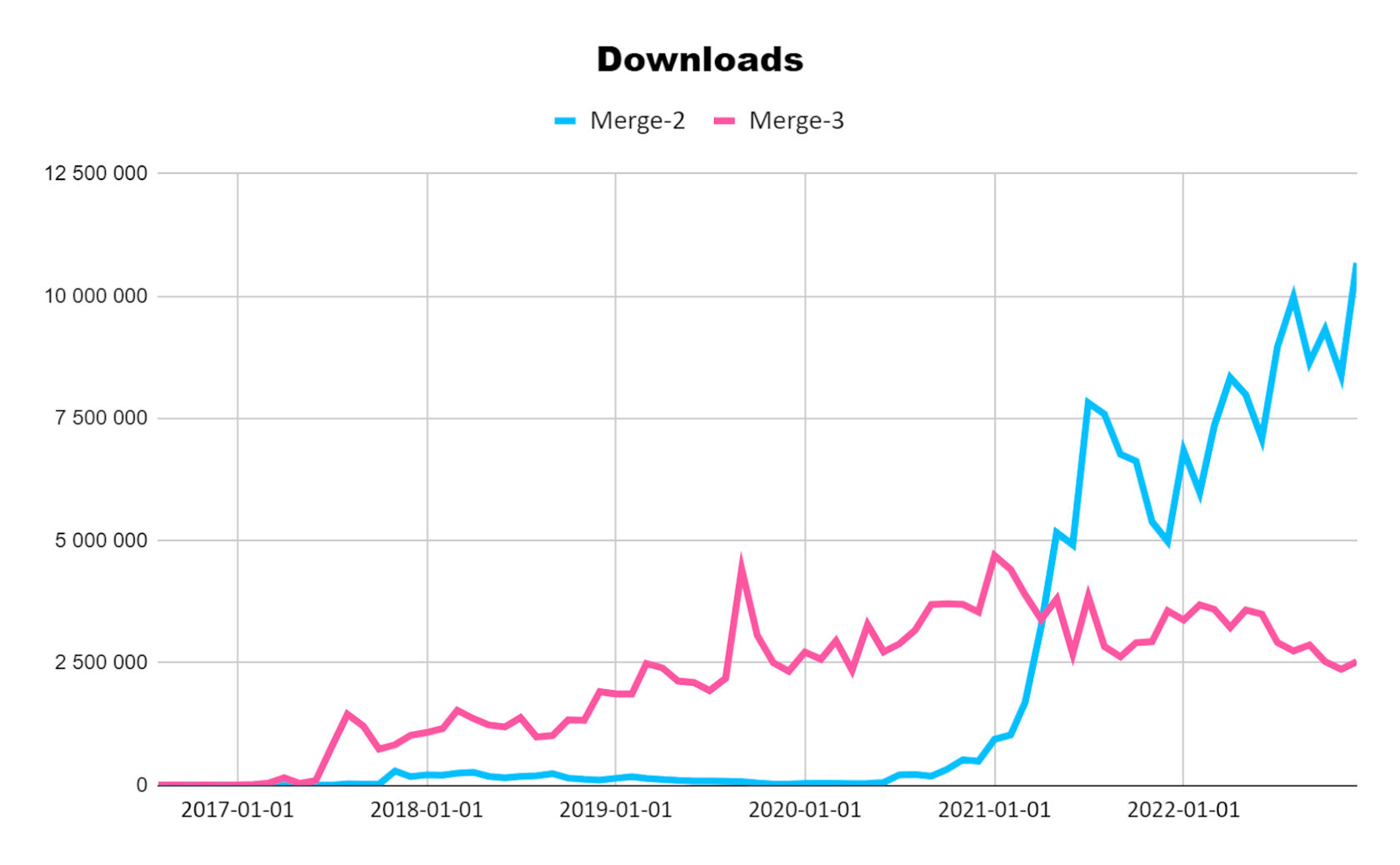

A different situation can be seen in the downloads trend, which shows a much more intense lift for Merge-2 in 2021, leaving Merge-3 far behind in 2022. Merge-2 reached around 10.7M downloads in December of 2022 compared to 2.5M for Merge-3.

Releases

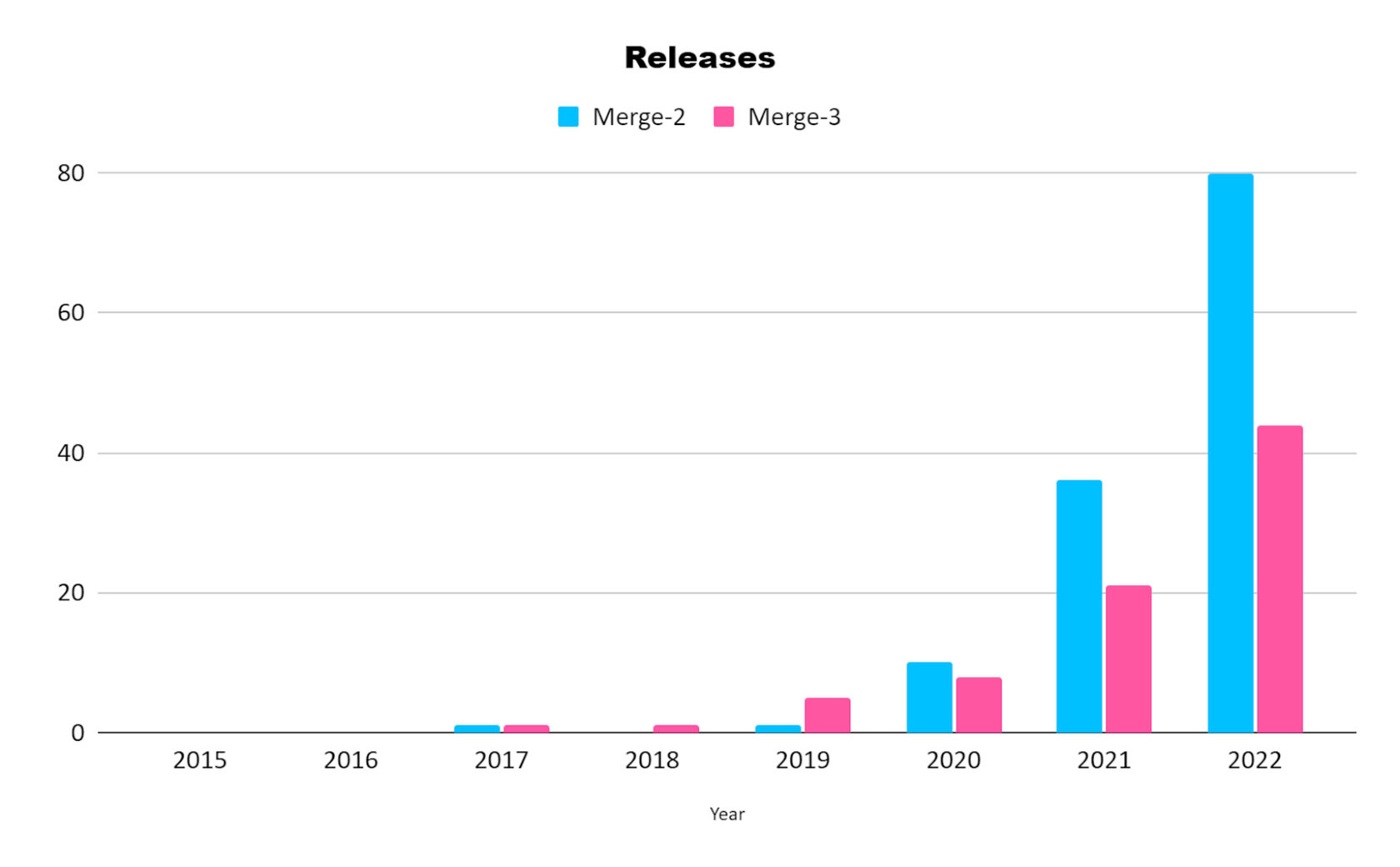

Both genres show the increasing number of releases through the years with the leading total of new titles in Merge-2 in recent years. In 2022, 80 titles were released in the Merge-2 genre and 44 in the Merge-3.

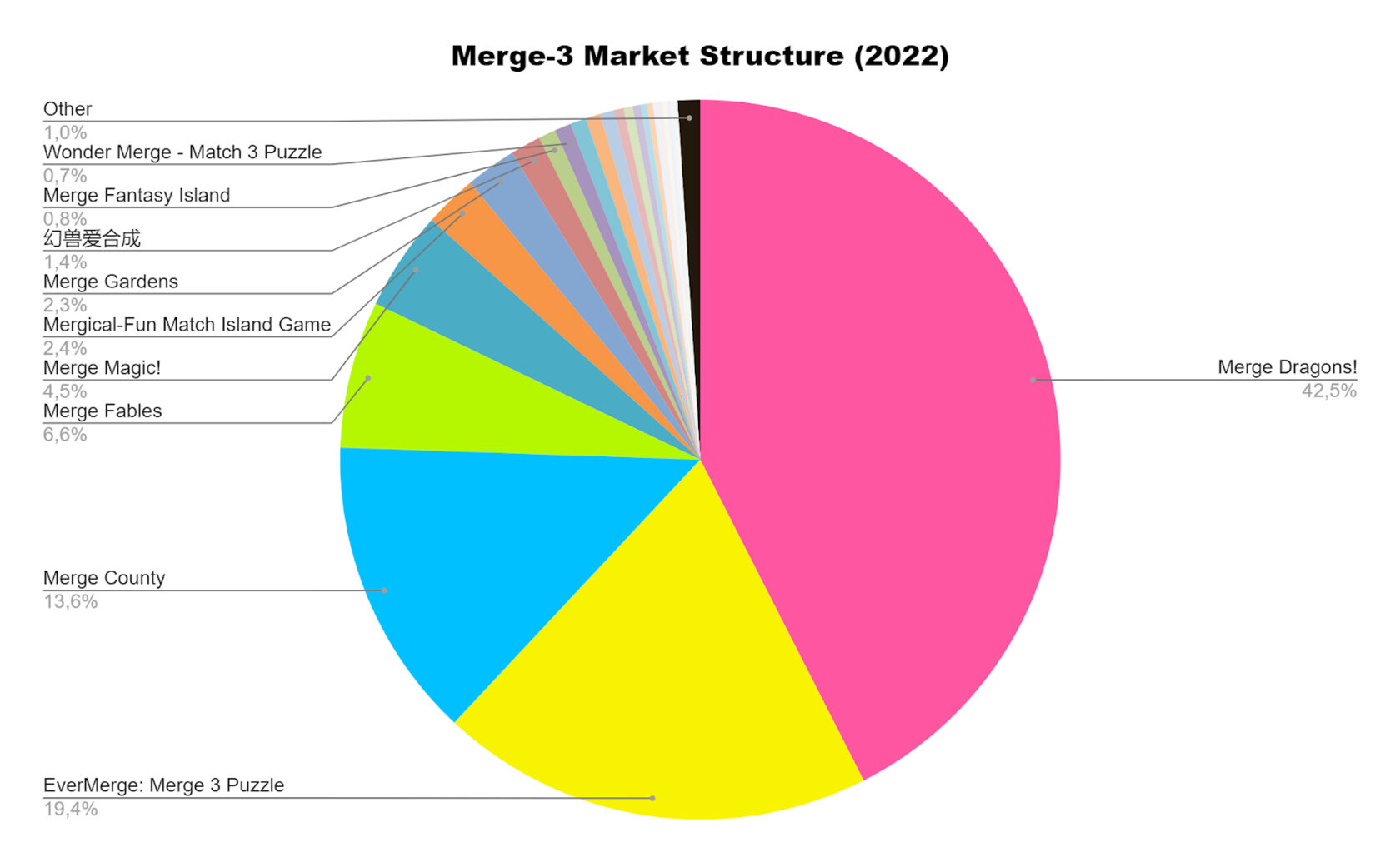

Market Structure

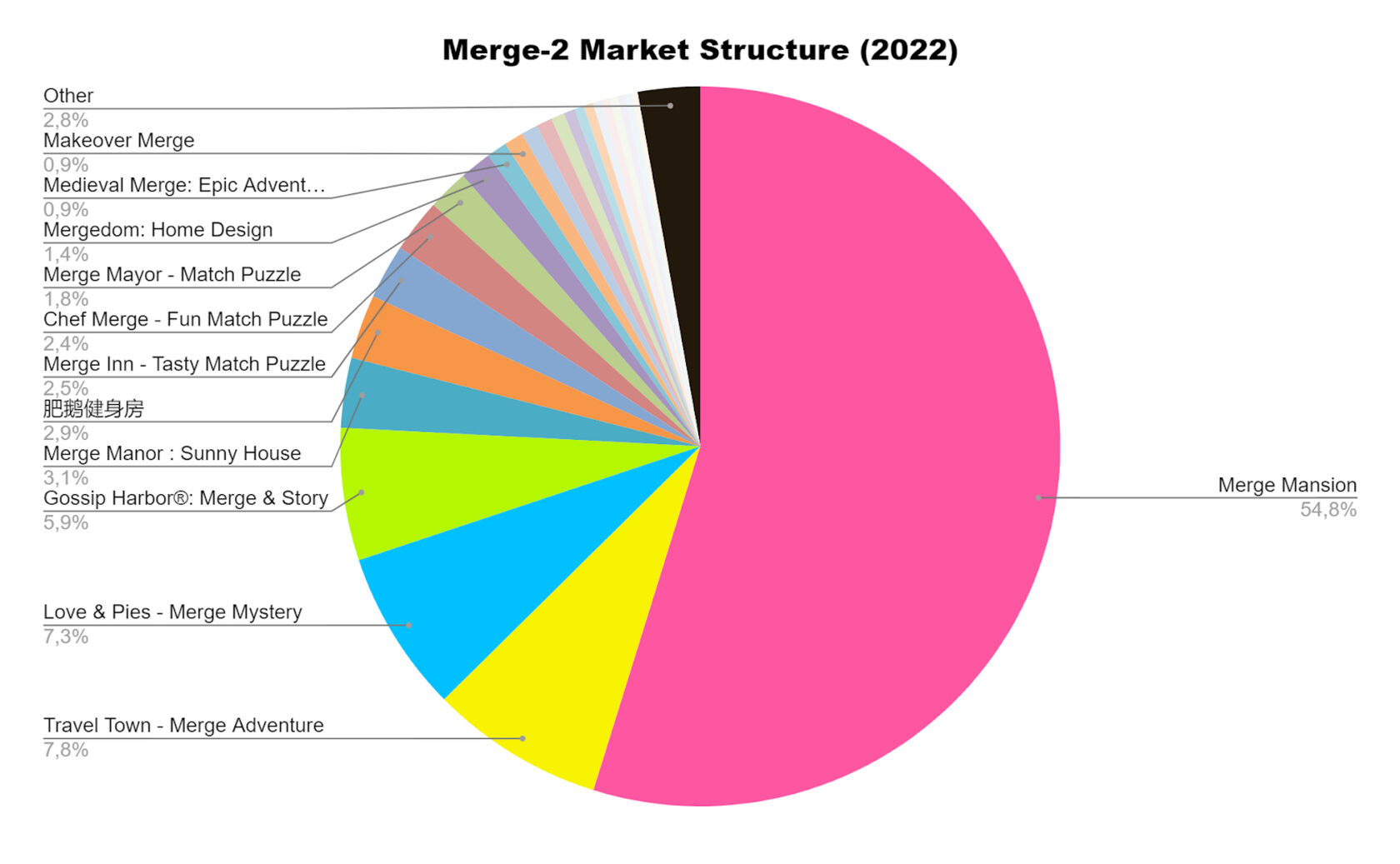

Merge-2 shows a more even distribution of income for 2022 than Merge-3. Though its leader occupies a larger market share (54.8% for Merge Mansion compared to 42.5% for Merge Dragons!), the IAP revenues of all other titles are more smoothly allocated. Overall, TOP-3 leaders of the Merge-3 market hold 75.5% of the generated IAP revenue, while approximately the same share is taken by the TOP-4 leaders of Merge-2 (75.8%).

Conclusion

Summing this up, both genres are considered promising, but Merge-3 represents a more established market than Merge-2, as the latter is still actively growing nowadays. Merge subgenres show significant volumes of IAP revenue and downloads, increasing number of released titles, and fine IAP revenue segmentation. However, Merge-2 shows better dynamics for both IAP revenue, downloads, and releases as well as it has a smoother revenue partition making this genre more attractive at the present time.Other articles in Analytics: